2023 - One Wild Ride

What a rollercoaster of a year 2023 has been. So much has happened in the commercial financing world it is hard to summarize it all. Now that we are in the final days of December, I hope to bring some perspective to what has certainly been a crazy year in the banking world and set some expectations for 2024.

The Outlook for 2024

We do believe the Federal Reserve will lower interest rates next year, and that will bring down short-term interest rates tied to the Prime rate.

We anticipate credit will start to loosen up at the start of 2024 due to the general need to grow and make money most Banks have. However, we believe credit will remain tight for lending categories and property types that are deemed higher risk, especially in the case of a recession, such as office and retail properties.

Although we believe there will be some decline in longer-term fixed interest rates as the Federal Reserve lowers interest rates, due to the fact the yield curve is still inverted (short-term interest rates are substantially higher than long-term interest rates), we are less confident that longer-term interest rates will come down as quickly as short-term interest rates. If Banks continue to struggle to maintain deposit balances, that would also cause long-term interest rates to stay higher as Banks are forced to pay more for deposits.

It does appear there are some economic headwinds that could impact the economy in 2024. Also, the fact 2024 is a Presidential election year, will likely play a role in economic activity in 2024. Even if there is a recession, we do not anticipate it will be deep and it does appear the economy is still humming along.

For CLX

2023 was a strong year for CLX as we continued to see loan demand growth. We got 75 loans approved for a total loan volume of $166 million, with still many loans to close in 2023 and early 2024.

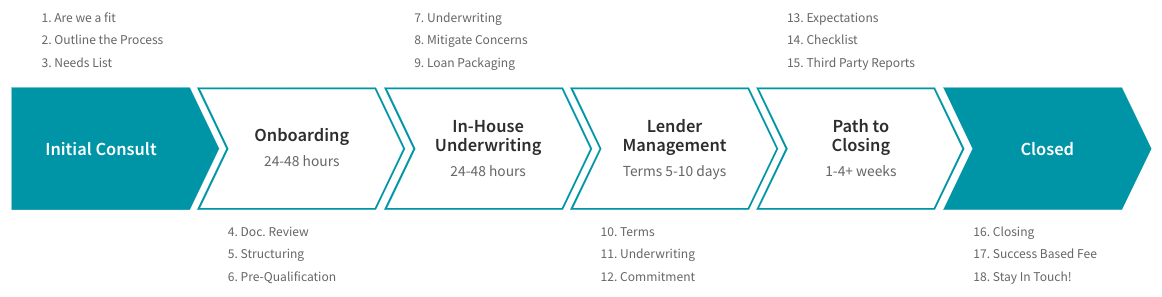

Here at CLX we released our updated process (shown below) to educate the market on exactly how we work here at CLX.

In 2023 we launched our video series with interviews and informational videos on commercial loans and lending, and we are excited to announce we will be greatly expanding our videos and educational material in 2024.

Banking Pressures in 2023

Pressure on interest rates started early in 2023 with the first Federal Reserve rate increase on February 1st, 2023 and three more increases throughout 2023 culminating in a 1.00% increase in the Prime Rate bringing it to 8.50%, the highest the Prime Rate has been since February 1st, 2001.

Pressure on the Banking industry was substantial in 2023 as the Federal Reserve rate increases greatly impacted the value of securities held on the books of most US Banks. As asset values fell at several large Banks, Bank liquidity became a problem causing mounting concerns that those Banks may fail. That concern led to deposit runs at two of those banks, Silicon Valley Bank and Signature Bank, both of which failed in March of 2023. They represented the third and fourth largest bank failures in U.S. history.

First Republic Bank Bank became the 2nd largest Bank failure in US history in May of 2023 as it could not recover from damage caused by lost deposits and investment portfolio performance.

The 5-year Treasury Yield experienced a roller coaster of a year starting the year at 3.94%, dropping to a low of 3.29% on 5/4/23, hitting a high of 4.95% on 10/19/23, and currently sitting at 3.91% as of 12/15/23, roughly inline with where it started the year.. As most lenders price fixed rate debt off of Treasury Rates, with the 5-Year Treasury being the most common interest rate used, the movement of treasury rates has had a significant impact on market interest rates. Most lenders price between 2.00% to 3.50% over the 5-Year Treasury Rate, meaning fixed interest rates have fluctuated between as low as 4.29% and as high as 8.45% for those lenders purely pricing based on treasury rates.

Money market interest rates and CD interest rates at most institutions at the start of 2023 were below 2% and some even below 1%. However, as deposit demand grew as Banks felt the liquidity crisis in March of 2023, Banks quickly raised deposit rates. Today money market rates are available north of 5% and CD rates are available even higher. That is an increase in the cost to fund loans at Banks of 4 to 5% within a one-year time frame, which is especially harsh when lenders had spent the past three years fixing interest rates on loans held on their balance sheets at interest rates between 3% and 5%.

Due to the higher cost of generating deposits, most Banks increased the spreads they were using over Treasury Rates from closer to 2.00% to 3.00% and higher, greatly increasing the fixed rates being offered on most loan products. Today we are seeing the largest spread we have ever seen in traditional lending for fixed interest rates. Usually the difference in interest rates charged on loans between Banks is 0.50% to 1.00%, and maybe 1.50% on the high side. Today we are seeing Banks charging fixed interest rates from 6.50% to 9.00%, a spread of 2.50%, the largest we have seen in our fifteen year history at CLX.

We saw a general tightening of credit from most U.S. based banks in 2023 as many Banks suffered liquidity problems. This tightening was further complicated by concerns Bankers had over the impact higher interest rates will have on the market and a concern that the economy could be approaching a recession.

According to Federal data, U.S. inflation hit a peak at 9.1% in June of 2022 and has been gradually coming down since then. Inflation is currently sitting around 3.00%, just above the Federal Reserve’s target of 2.00%, leading the Federal Reserve to announce at their December meeting that interest rates could start to come back down in 2024, with currently three projected rate decreases in 2024. This could lead to lower interest rates in 2024 and beyond.

So far the economy has not dropped into recessionary territory with GDP growth at 2.2% in the 1st quarter of 2023, 2.1% in the 2nd quarter of 2023, and 4.9% in the 3rd quarter of 2023. Although there is concern the economy is slowing, so far that concern has not been reflected in the U.S. GDP, which has continued to grow through the first three quarters of 2023.

2023 has certainly been an interesting year, and with 2024 being an election year, there is sure to be plenty of drama in 2024 as well. But overall the economy appears to be on strong footing and there are plenty of lending options available, whether government backed programs, conventional bank financing, or non-bank lenders, to support most businesses and real estate investors regardless of what the economy does in 2024.

Here at CLX we have put into place the tools and the structure to help as many clients out as possible, and we look forward to another successful growth year in 2024. We are here to assist you however we can.