CLX Advisory Service

As a general rule, CLX works on a “success fee basis.” If, after reviewing your deal, we are not confident that we can get it done, we offer an alternative path called CLX Advisory Service.

This service entails charging a consulting fee, as we lack the confidence in the ability to secure financing for your deal, and need to ensure we are compensated for the time and effort invested into underwriting and attempting to secure financing.

Any amount paid towards this fee will be credited towards our standard 1% success fee if we successfully close your deal.

Brad Hettich, President of CLX

Highlighted Transactions

-

The Client was seeking to acquire the stock purchase of media business via the SBA 7A loan program. We were able to secure SBA 7A financing at a solid rate to facilitate the acquisition.

-

The Client was seeking to purchase a commercial / industrial building to relocate their business into. We were able to secure financing with a traditional lender at a strong fixed rate to facilitate the acquisition.

-

The Client was seeking to refinance the original acquisition loan for the commercial hotel property they owned after having completed improvements to the hotel. We were able to secure financing with a traditional lender at a strong fixed rate to facilitate the refinance.

-

The Client was seeking a commercial bridge loan to facilitate the acquisition of a hotel property. We were able to secure hard money financing with a private lender to meet the Client’s needs.

-

The Client was seeking financing to acquire land to construct medical office condos. We were able to secure an approval with a traditional lender to provide both construction financing and the end loan take out for the new condos.

-

The Client was seeking to establish a line of credit to fund working capital and growth for their business despite operations for only about a year. We were able to secure a line of credit with a high advance rate on both inventory and accounts receivable at reasonable terms to help fund the Client’s growth.

-

The Client was seeking to refinance and consolidate the existing equipment debt of their business. We were able to secure financing with a traditional lender and a solid interest rate and using the SBA 7A loan program we were able to extend the term out on the equipment from five years to ten years, greatly enhancing the Client’s cash flow.

-

The Client was seeking to finance the acquisition, improvements and equipment needs for a commercial office building via the SBA 7A loan program. We were able to secure SBA 7A financing at a solid rate to facilitate the acquisition, improvements and equipment needs of the Client.

How does it work?

Consulting Agreement – As a client of CLX, you would enter into and sign a consulting agreement with CLX for our CLX Advisory Service.

Payment of Initial Retainer – CLX would require payment of an initial retainer of $5,000. All work we complete on your behalf will be charged at an hourly rate of $195. We will track all time spent working on your behalf to secure financing. As work gets completed, the amount charged per hour gets deducted from the $5,000 retainer that you have provided to CLX.

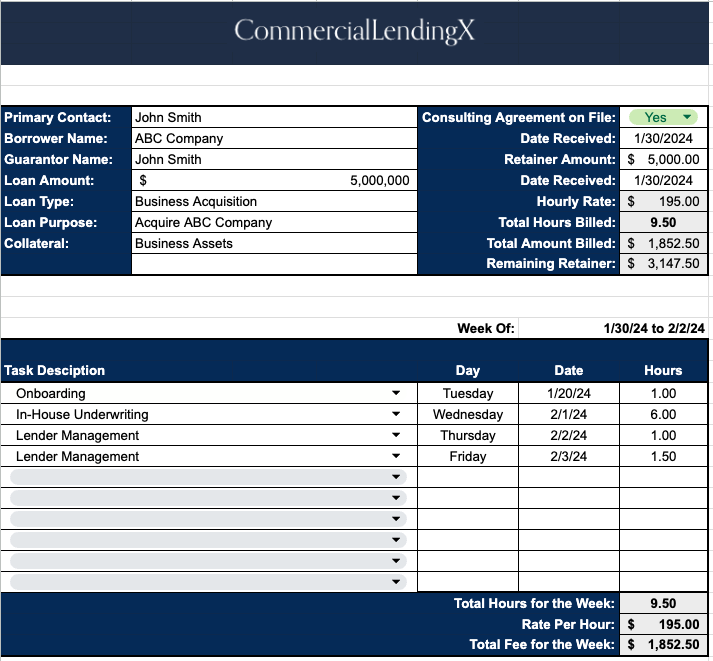

Tracking of Consulting Time Spent & Retainer Money – We commit to providing our clients a weekly update and tracker to show all time spent on your behalf and the hourly rate charged for those hours for our consulting work. Each week you will see how your initial retainer funds are being utilized, and what the remaining balance is left on that retainer. Should your deal be complex and you use up the full retainer, we will let you know and you can decide if you would like to continue moving forward to pursue financing options by submitting an additional retainer to CLX, or if you would like to end our consulting agreement and part ways.

Closing on Your Deal – Due to the level of difficulty of your deal, we may or may not be able to secure financing and close on your loan. If we do not close on your deal, you have paid us at the hourly rate of $195 from the retainer you have provided to CLX. If we DO close on your deal, anything you have paid towards consulting fees will count towards our standard 1% success fee.

Sample CLX Advisory Tracker

FAQ

What is included in the consulting agreement? – The consulting agreement outlines the scope of work, terms and conditions, hourly rates, and retainer fee requirements. It also details the responsibilities of both CLX and the client.

What happens if there are unspent funds from the retainer? – Any unspent funds from the retainer will be refunded to you if we decide not to proceed with further consulting services or if the deal is closed and the remaining funds are not needed.

How do I decide if I should continue with additional retainers? – We will provide regular updates and assessments of the progress made towards securing financing. Based on these updates, you can make an informed decision about whether to continue pursing financing options and submitting an additional retainer deposit with CLX.

Can I terminate the consulting agreement at any time? – Yes, you can terminate the consulting agreement at any time. However, you will be billed for any consulting hours worked up to the point of termination.

What happens if we are close to securing financing but the initial retainer is exhausted? - If we are close to securing financing but the initial retainer is exhausted, we will inform you immediately. You can then decide whether to provide additional retainer funds to continue our efforts or terminate the agreement.

What additional costs can occur after a term sheet is issued, and what happens if the loan is not approved? - After a term sheet is issued by a lender, there may be additional costs required to move towards a full loan approval. These costs can include fees for appraisals, environmental reports, and other due diligence items, and the lender may require a deposit from you to cover these expenses. It’s important to note that these costs are separate from our consulting fees. Occasionally, despite these efforts and expenses, the lender may not be able to approve the loan. In such cases, the costs already incurred for third-party services (such as appraisals) are typically non-refundable. We will keep you informed about any required deposits and potential costs upfront, and provide guidance throughout the process to help manage these expenses. Our role is to facilitate the process and assist you in navigating these steps, ensuring you are aware of all potential costs and risks involved.

What types of deals does CLX typically handle? - CLX specializes in a variety of deals, including commercial real estate, business acquisitions, and other complex financing arrangements. Our team assesses each deal individually to determine the best approach and structure the deal in the best possible way for success.

How long does the consulting process typically take? - The duration of the consulting process varies depending on the complexity of your deal. We provide regular updates to keep you informed of our progress and any potential timeframes.

What qualifies as a complex deal? - A complex deal may involve significant due diligence, multiple financing sources, intricate legal structures, or challenging market conditions. We evaluate each deal’s specific challenges during our initial review.

What happens if my deal is not successful? - If we are unable to secure financing and close your deal, you will only be responsible for the consulting hours worked, billed at the hourly rate of $195, deducted from your retainer. Any costs incurred from one of our lending partners are separate from CLX and you may be responsible for costs to third-party vendors that are requested from one of our lending partners while trying to get your loan approved.

How do you ensure transparency during the consulting process? - We provide weekly updates detailing the time spent on your deal and the remaining balance of your retainer. This ensures you are always aware of the progress and costs involved.

Can the hourly rate change during the consulting process? - The hourly rate specified in the consulting agreement remains constant throughout the duration of the agreement unless otherwise agreed upon by both parties in writing.

What if I have additional questions or concerns during the consulting process? - You can contact CLX at any time with questions or concerns. We are committed to providing timely and thorough responses to ensure your piece of mind.

Why does securing a commercial loan take longer than a personal loan? - Securing a commercial loan typically takes longer than a personal loan due to the complexity and size of the transaction. Commercial loans often require extensive due diligence, including detailed financial analysis, property appraisals, environmental reports, legal reviews and more. This process can take several weeks or even months to complete. At CLX, we strive to keep you informed throughout the process with regular updates, ensuring transparency and clarity about the timeline and progress of your deal.